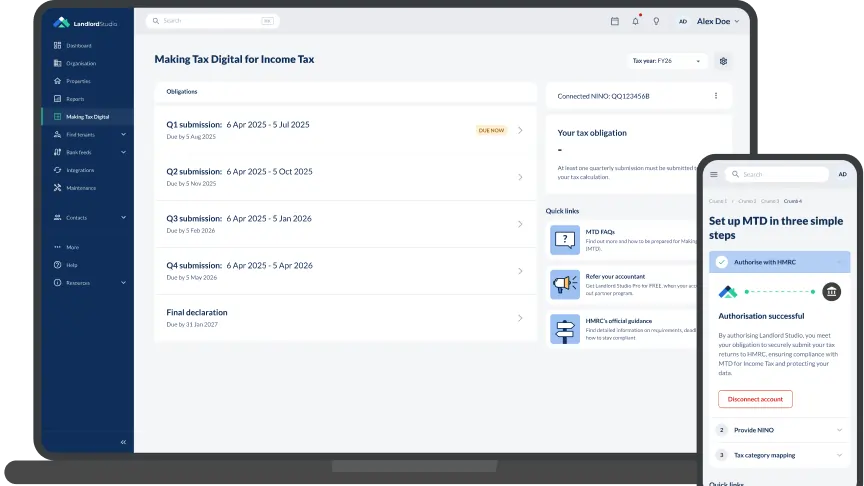

Making Tax Digital for UK landlords

Everything you need to understand MTD compliance, avoid penalties, and file with confidence.

Start Here: Top MTD Resources

Start with the most helpful MTD resources: a quick video, an interactive quiz, and a complete guide to get you ready.

Making Tax Digital - The complete guide

A complete introduction to MTD requirements, who’s affected, and what you need to do.

8

min read

Updated

Dec 2025

8

min read

Updated

Dec 2025

Making Tax Digital - The complete guide

A complete introduction to MTD requirements, who’s affected, and what you need to do. A complete introduction to MTD requirements

8

min read

Updated

Dec 2025

8

min read

Updated

Dec 2025

Making Tax Digital - The complete guide

A complete introduction to MTD requirements, who’s affected, and what you need to do.

8

min read

Updated

Dec 2025

8

min read

Updated

Dec 2025

Start Here: Top MTD Resources

Join 100,000+ UK landlords using Landlord Studio. It’s quick to set up, simple to use, and gives you confidence that everything is accurate and up to date:

- Track expenses on-the-go

- Generate HMRC-ready reports instantly

- Stay fully compliant

Making Tax Digital - The complete guide

A complete introduction to MTD requirements, who’s affected, and what you need to do.

8

min read

Updated

Dec 2025

8

min read

Updated

Dec 2025

MTD Masterclass | Preparing Landlord Clients for MTD with Digital Workflows

Join our 5-part MTD masterclass for UK accountants. Learn how to prepare landlord clients for quarterly digital submissions with expert guidance and practical strategies.

8

min read

Updated

Dec 2025

8

min read

Updated

Dec 2025

.jpg)

.jpg)

.jpg)

.png)

%20(1).jpg)

.jpg)

.webp)