Welcome! Where would you like to log in today?

Sign up and get

PRO free for 14 days

Once your PRO trial is over you can continue using Landlord Studio GO completely free.

By continuing you agree to our Terms & Conditions.

It takes time and patience to keep up with the latest buy-to-let regulations to ensure your property is up to code and remains profitable.

Written by

Kate Faulkner

PUBLISHED ON

Jul 16, 2025

Managing a successful buy-to-let in today’s post-pandemic world isn’t easy. It takes a lot of time and patience to keep up with the latest rules and regulations to ensure you deliver a property that’s an effective operation for yourself and a safe home for your tenants.

Since 2020, UK landlords have faced a near-constant stream of legal and regulatory updates. From pandemic-era eviction bans to energy efficiency deadlines and the upcoming planned abolition of Section 21, the private rental sector has rarely stood still. Blink and you could easily have missed a change or two.

With that in mind, here are my 7 top tips to help you manage your buy-to-let properties:

Staying on top of your rental income and expenses is essential—not only for cash flow but also for tax efficiency. Misplaced receipts or unlogged mileage could mean you miss out on deductible expenses, paying more tax than necessary.

Additionally, inflation has driven up the costs of building materials and labour. So, if you’re planning renovations, be sure to update your budget accordingly.

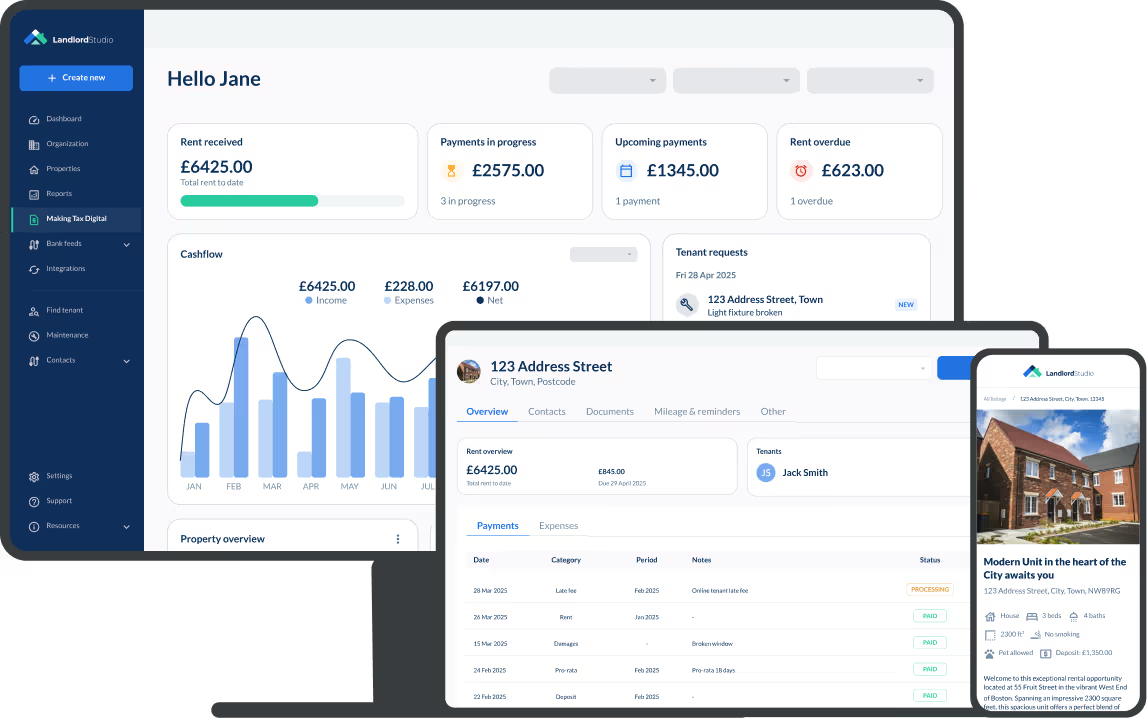

With Making Tax Digital (MTD) rolling out from April 2026 (starting with landlords earning over £50,000 annually), now is the time to get familiar with digital accounting software. Tools like Landlord Studio let you track income, expenses, mileage, and even scan receipts on the go simplifying your tax reporting and ensuring you meet MTD requirements.

Related: Using Landlord Studio And Staying MTD Compliant

One of the most common financial pitfalls landlords face is being unprepared for major repairs. Boilers, windows, roofs, kitchens—these can all cost thousands, and most will need upgrading at least once during your ownership.

Set a 10-, 15-, or 20-year maintenance plan to help you anticipate and budget for big-ticket items. Include regular maintenance, décor refreshes, and emergency repairs too. It all adds up.

Energy efficiency upgrades are another key area. As of now, it’s illegal to rent out properties F and G rated on the EPC scale (unless exempt). By 2030, all rental properties in England and Wales must meet EPC rating of C or above.

Many landlords are already tackling this. Look into available green grants or tax-deductible improvements now, before the market rush.

Even seasoned landlords struggle to keep up with changing legislation. That’s why working with trusted professionals is essential. Consider using a letting agent registered with ARLA or RICS, or at the very least, join a landlord association that provides legal updates and guidance.

Ultimately, even if you use an agent, you are legally responsible for compliance—licensing, health and safety, deposit protection, and more. Ignorance is no excuse if something goes wrong.

The next big change? Well, there are two main ones that have been making headlines, Making Tax Digital for Income Tax. Landlords earning over £50,000 must submit quarterly updates from April 2026, with the threshold lowering in future years. Adopt digital tools now so you’re not scrambling later. And The Renters Rights Bill which seeks to abolish Section 21, enforce rent increase caps, andget rid of fixed-term tenancies.

To get ahead of these deadlines, adopt digital tools Landlord Studio, which are built with compliance and MTD readiness in mind.

Related: An Update on the Renter's Rights Bill: It's Worse Than We Thought

Any work done on your property must meet rental sector standards. That means hiring qualified, insured, and accredited contractors who understand current regulations—like the updated electrical safety rules introduced in 2021.

A knowledgeable tradesperson will ensure your property is not only legally compliant but also future-proofed against upcoming regulation changes.

A surprising number of landlords reuse old tenancy agreements or modify them with unverified clauses—this is a huge risk. Tenancy laws evolve constantly, and your agreement must reflect current standards.

Use a professionally drafted agreement that is updated regularly, or download the government’s model tenancy agreement (available for free). But be warned: it's 64 pages long and won't notify you when it's updated—so regular reviews are still essential.

Inspections help protect your investment and build trust with your tenant. Begin with a detailed, photo-supported inventory. Schedule follow-up visits every 3–6 months to spot maintenance issues early and ensure the tenant is happy and following the terms of the agreement.

Approach these inspections as a chance to maintain communication—not as surveillance. A strong landlord-tenant relationship often leads to quicker issue reporting, fewer surprises, and better retention.

While long-term tenants can be a blessing, holding rent steady for years could mean your income lags behind inflation and market rates. Ideally, review rent once a year and adjust where appropriate.

Under the afore-mentioned Renters Rights Bill, rent increases will be limited to once per year, with tenants receiving at least two months’ notice. That makes accurate, timely reviews even more important.

Also, monitor your property’s market value. Rising equity could enable you to remortgage to a better rate or release funds for new investments or renovations.

One of the smartest ways to stay on top of everything—compliance, finances, documents, and communication—is to adopt a digital solution built for landlords.

Property management platforms like Landlord Studio let you:

With all your data in one place, you’ll save hours of admin time and significantly reduce your risk of non-compliance. In a world where regulation is only increasing, it pays to be organised.

Owning rental property isn’t just about passive income, it’s an active business that requires systems, oversight, and compliance. But with the right processes and tools in place, you can turn complexity into confidence.

Stay informed. Build a reliable team. Invest in your property. And don’t be afraid to embrace technology. Whether you’re managing one flat or an entire portfolio, running your buy-to-let efficiently will ensure it remains profitable and keeps your tenants happy for years to come.

Create your free Landlord Studio account today to help streamline your property management and compliance.