Welcome! Where would you like to log in today?

Sign up and get PRO free for 14 days.

Once your PRO trial is over you can continue using Landlord Studio GO completely free.

By continuing you agree to our Terms & Conditions.

What is Making Tax Digital (MTD) and how can the Landlord Studio property management software help you stay compliant?

Written by

Ben Luxon

PUBLISHED ON

19

Dec

2022

As a landlord, it can be challenging to keep up with the changing regulations. One upcoming new requirement for landlords in the UK is to ensure that you’re complying with the Making Tax Digital (MTD) rules.

Making Tax Digital (MTD) is a new initiative from the UK government designed to modernize the tax system and make it easier for businesses to stay on top of their tax obligations. Under the new rules, which will be phased in from April 2026, all landlords with income over £50,000 per year are required to keep digital records and submit their tax returns using compatible software.

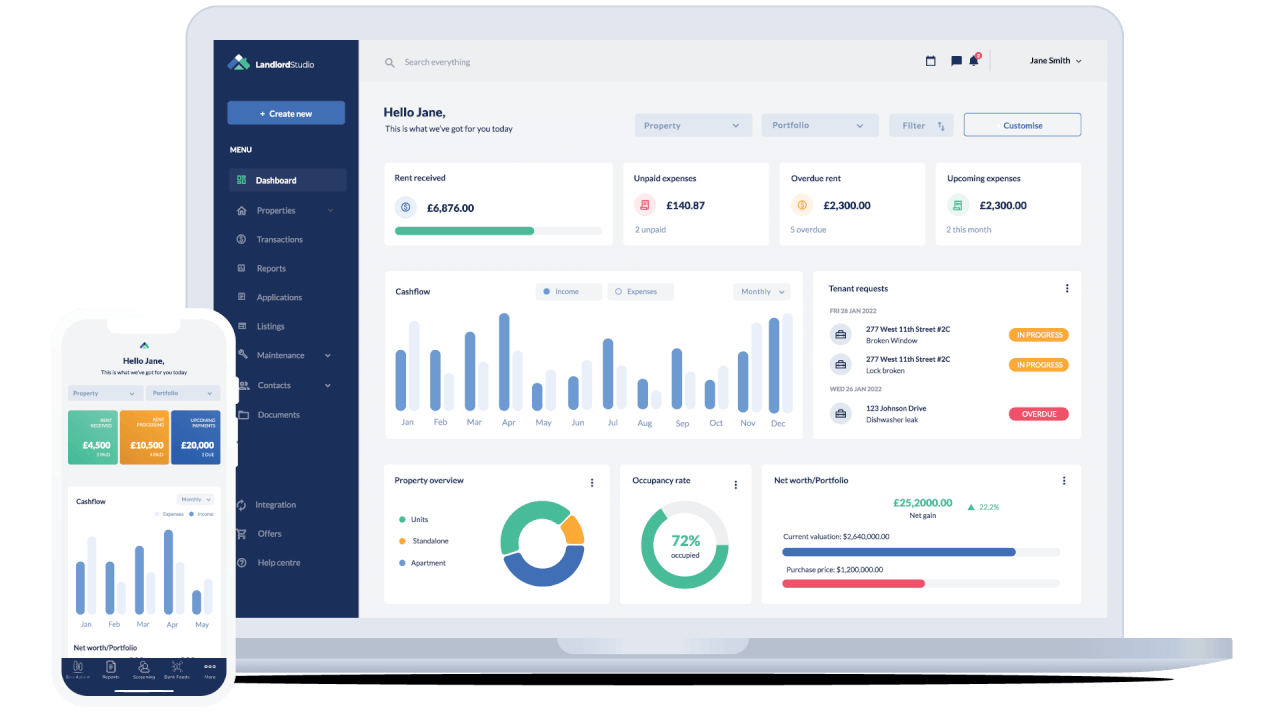

This is where Landlord Studio comes in. Landlord Studio is a comprehensive property management and accounting software that has been designed specifically for UK landlords. It includes a range of features that can help you stay compliant with everything from tax compliance to safety inspections such as document storage, personal reminders, bank feeds and a range of accountant-approved reports.

With the upcoming MTD change, Landlord Studio makes it easier than ever to keep digital records and we will be HMRC approved before the deadline.

If you do want to carry on using your existing systems, you will need to find an approved bridging software. However, MTD represents an opportunity to upgrade your accounting systems to help you save time and money. And with leading solutions like Landlord Studio completely free, you’ve nothing to lose.

Learn more about MTD with our free resources →

HMRC-approved accountancy software needs to integrate with the HMRC API. Once they have proved that they can do this integration they go through a demonstration and approval process.

What this integration does is allow the software to ‘talk’ directly with the HMRC meaning you’ll easily be able to review your rental income tax requirements and submit your quarterly returns and end-of-year statement with a few quick clicks.

The real advantage of using software like Landlord Studio which has both desktop and mobile software is that you can track your rental property income and expenses in real-time. Our receipt scanner allows you to digitise receipts when you get them (no messy folders or lost receipts), and our bank feeds feature allows you to import transactions into the app to view and reconcile them as they happen.

The idea behind MTD is to reduce human error, get rid of that big accountancy task at the end of the year, and create better transparency and understanding of your tax obligations. You will be able to simply review the accounting you’ve done as you go along, and then submit your end-of-year statement with a click.

However, MTD represents a massive change in how landlords and self-employed people are required to manage their accounts. Spreadsheets simply won’t cut it anymore. You need a system for accurate digital record keeping.

If you’re already using Landlord Studio then that means you’re already keeping digital records. And you don’t need to do anything else at this time. But, if you haven’t yet looked into upgrading your accounting processes, now is the time to do it.

In addition to its tax-related features, Landlord Studio also includes a range of tools that can help you manage your properties more effectively. The software allows you to keep track of your tenants, leases, and property inspections, and we have a range of templates and checklists that can help you stay organized and on top of your responsibilities as a landlord.

With Landlord Studio your first 3 properties are completely free and we will be HMRC approved before the deadline.

If you’re currently required by the HMRC to submit your VAT return digitally then you can use our streamline Xero integration. Easily track your rental property income and expenses via the Landlord Studio app, and we will automatically push all of your financial data to Xero for you. Avoid double-handling of data, save time, and become MTD compliant today.

Overall, Landlord Studio is a valuable tool for UK landlords looking to stay compliant with the new Making Tax Digital rules. Its comprehensive set of features, combined with its user-friendly interface, make it an essential tool for anyone looking to simplify their tax filing process and manage their properties more efficiently.

We hope you found this blog interesting! However, do note that it should not be used as a substitute for competent legal and/or other advice from a licensed professional